Where Our Beans Go, Who Pays More, and What Farmers Should Know

Soya bean production has become an increasingly important part of Zambia’s agricultural economy, both as a food security crop and as a source of income for farmers and agribusinesses. While local markets remain a key outlet for most producers, export demand continues to grow across the region, raising an important question: does exporting soya beans offer better returns than selling locally?

This analysis looks at Zambia’s soya bean export performance between 2021 and 2022, examining production patterns, export volumes, price trends, and regional competition. The objective is not to build an academic model, but rather to translate trade data into practical insights that farmers, aggregators, and agricultural decision-makers can actually use.

All prices are compared on a per-kilogram basis, with export values converted to Zambian Kwacha using a uniform exchange rate of K23 to US$1 to ensure comparability.

Where Soya Beans is Grown in Zambia – Provincial Production Patterns

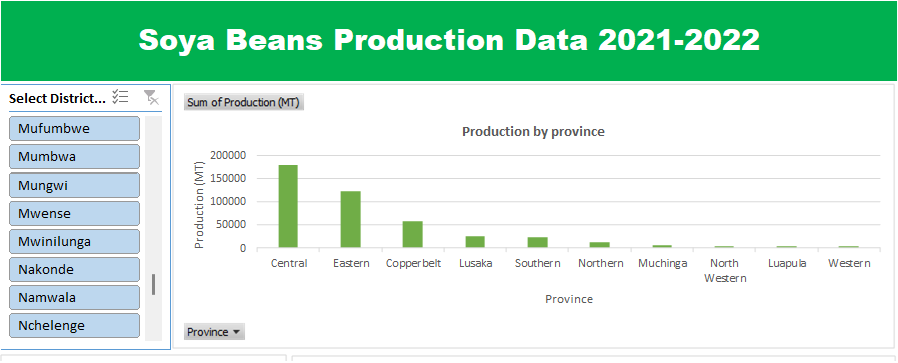

Soya bean production in Zambia is unevenly distributed across provinces. A small number of regions account for the bulk of national output, reflecting differences in rainfall patterns, soil suitability, access to inputs, and market connectivity.

Production data in figure 1 shows that Zambia’s soya bean output is concentrated primarily in Central and Eastern Provinces. These two regions consistently contribute the majority of Zambia’s total production, reflecting favourable soil conditions, commercial farming presence in Central, and widespread smallholder participation in Eastern. This concentration reflects more than just agro-ecological suitability. Other provinces such as Copperbelt and Southern produce moderate volumes, while provinces like Luapula, Muchinga, and North-Western remain relatively small contributors. This uneven distribution helps explain why aggregation and export activity are more active in Central and Eastern regions.

Figure 1. Provincial Soya bean Output (MT) – Central & Eastern Provinces dominate

From an export perspective, this information matters because consistent production volumes are a prerequisite for participation beyond local spot markets. Provinces with higher output are structurally better placed to supply aggregators and exporters, while lower-producing regions remain largely tied to local sales.

Zambia’s Soya Beans Export Quantity and Price Insight – Who Buys our soya and at what price?

In 2021, Zambia received ~K17.69/kg from India and ~K14.85/kg from South Africa, both comfortably above the local FRA price of K10/kg. Zimbabwe paid only ~K9.27/kg, below the domestic benchmark, showing that not all export destinations translate to superior returns. When you convert these export prices to kwacha using K23 per USD, the gap between markets becomes clear. DRC and Angola offer a meaningful premium above local rates; others barely beat the Zambian market once logistics and handling costs are included.

Dashboard shows Export Quantity(kg) and Price(USD/kg) by Destination (2021–2022) Higher prices do not always mean higher volumes

The numbers also show a simple pattern: the bigger the shipment, the lower the price per kg. Tanzania and Zimbabwe typically take bulk volumes but at lower rates. India tends to pay more, but the volumes are smaller. South Africa sits in the middle, steady rates, moderate quantities.

Blank cells indicate destinations with no recorded exports in that year, not missing prices. Zambia did not ship to those markets in 2021, 2022 or 2023

What matters for farmers and aggregators is the net price, not the headline export price. Transport, drying, cleaning, and commissions can easily shave off K1–K4 per kg. If that cost is higher than the export premium, exporting becomes pointless. But when the export price stays well above the local rate even after costs, it becomes a real opportunity, especially for organised groups that can secure clean, consistent quality.

Some countries consistently absorbed larger volumes, indicating established trade relationships and logistical channels, while others appeared intermittently in the data with smaller shipments. Overall, despite Angola and DRC receiving smaller tonnages compared to South Africa or Tanzania, these markets offer higher per-unit value. This reinforces an important insight: high-volume markets are not always the highest-paying, and smaller, niche purchasers can offer premium pricing depending on their domestic supply gaps. The takeaway is simple: Exporting pays, but only when you know your buyer, control quality, and calculate the true net return per kg.

What Farmers Are Paid Locally: FRA Soya Bean Prices

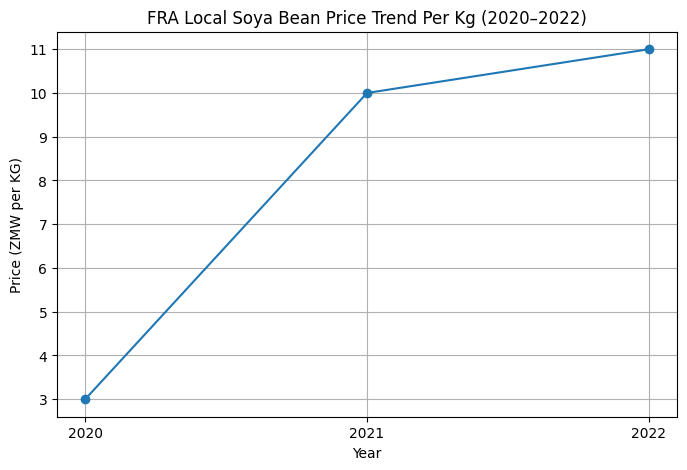

Local soya bean pricing in Zambia is strongly influenced by the Food Reserve Agency (FRA) floor prices. These prices provide income stability for farmers and act as a benchmark across domestic markets.

Between 2020 and 2022, FRA prices showed an upward trend as seen in figure 2. However, this increase largely reflects higher input costs, rising inflation, and general macroeconomic pressures rather than direct signals from export markets.

Figure 2. Price in local FRA soya beans prices shows upward trend from K3/kg in 2020 to K11/kg in 2022.

While FRA prices protect farmers from extreme price volatility, they do not necessarily reflect the full value of soya beans in higher-priced external markets. This creates a gap between domestic price stability and potential export value, a gap that export-oriented actors may seek to exploit.

FRA’s local purchase price rose significantly between 2020 and 2022. The official floor price increased from K3/kg in 2020 to K10/kg in 2021, and K11/kg in 2022. This reflects rising demand, higher production costs, and stronger regional market pull. These local prices form the baseline against which export prices can be compared to assess potential profitability.

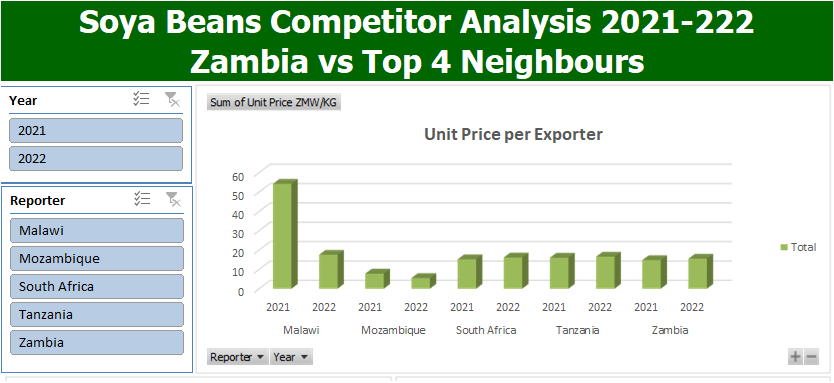

Regional Competition: How Zambia Compares to Other Exporters

Zambia is not alone in supplying soya beans to regional and international markets. Countries such as Tanzania, Malawi, South Africa, and Mozambique are Zambia’s top 4 competitors and all compete within overlapping buyer networks.

When export prices are compared on a per-kilogram basis, clear differences emerge. Figure 3 reveals that Mozambique consistently exports at very low unit prices ~K7.79/kg in 2021 and K5.51/kg in 2022), positioning itself as a cost-based exporter. This strategy allows it to move large volumes but places downward pressure on regional prices.

Figure 3. Regional competitor export prices in ZMW/KG. Mozambique exports the cheapest soya while Malawi and Tanzania export at premium levels.

Tanzania and Malawi (~K54.24/kg in 2021) tend to export at higher unit prices, reflecting differences in production scale, quality differentiation, or destination markets. Zambia sits between these extremes: more expensive than Mozambique, but generally competitive with Tanzania and South Africa.

This positioning suggests that Zambia’s competitive advantage does not come from being the cheapest supplier, but rather from being a reasonably priced, reliable source within the region.

Local vs Export Prices: Is Exporting Economically Feasible?

A direct comparison between local FRA prices and export unit prices reveals a consistent pattern across 2021 and 2022. When export prices are converted into Zambian Kwacha, export unit values are generally higher than local market prices.

The comparison tables below show Zambia’s export unit price versus local FRA prices:

Table 1 – 2021 Comparison Zambia’s export unit price versus local FRA

| Country | Export Price USD/kg | Export Price ZMW/kg | Local FRA Price | Difference (Export–Local) | Feasibility |

| South Africa | 0.645545 | 14.85 | 10 | 4.85 | Export profitable |

| India | 0.768888 | 17.69 | 10 | 7.69 | Highly profitable |

| Tanzania | 0.615318 | 14.16 | 10 | 4.16 | Profitable |

| Zimbabwe | 0.403031 | 9.27 | 10 | -0.73 | Local better |

Table 2 – 2022 Comparison Zambia’s export unit price versus local FRA

| Country | Export Price USD/kg | Export Price ZMW/kg | Local FRA Price | Difference (Export–Local) | Feasibility |

| South Africa | 0.71379 | 16.42 | 11 | 5.42 | Export profitable |

| Tanzania | 0.783056 | 18.01 | 11 | 7.01 | Highly profitable |

| Zimbabwe | 0.577733 | 13.29 | 11 | 2.29 | Export slightly better |

| India | 0.580492 | 13.35 | 11 | 2.35 | Export slightly better |

On paper, this indicates clear price incentives for exporting. However, price alone does not determine profitability. For example, while local prices ranged around K10–K11 per kilogram, export unit values averaged closer to K14–K16 per kilogram. On paper, this price differential suggests export incentives. However, the data also shows that higher prices are not necessarily associated with higher export volumes. In practice, the apparent export premium can be eroded by transport, aggregation, and compliance costs, especially for smaller producers. These costs can quickly erode the apparent price advantage if scale and coordination are weak.

For small-scale farmers selling individually, local markets often remain the safer and more practical option. For organised farmer groups, cooperatives, and aggregators able to move volume efficiently, export markets offer meaningful upside and diversification away from domestic price controls.

Export feasibility, therefore, is less about absolute price differences and more about scale, organisation, and market access.

Why Export Price Averages Mislead

Export price data shows substantial dispersion across destination markets within the same year. In both 2021 and 2022, some countries paid significantly higher unit prices than others, despite receiving smaller volumes. Angola and the Democratic Republic of Congo, for example, appear as higher-price markets, while larger-volume destinations tend to pay lower average prices. This trade-off means that simple average export prices mask important structural realities:

Table 3. Zambia local vs export average prices (ZMW per kg)

| Soya Beans Producer | Year | Unit Price ZMW/KG (Weighted Average price) | Local price |

| Zambia | 2021 | 14.78725 | 10 |

| Zambia | 2022 | 15.53389 | 11 |

In 2021, Zambia’s weighted average export price was ~K14.79/kg exceeding FRA’s local price of K10/kg by ~48%. These prices vary according to the country Zambia is exporting to. Zambia can sell more at lower prices or less at higher prices, but rarely both simultaneously. Export strategy therefore, involves balancing volume stability against price optimisation.

What the Data Suggests for Farmers and Agribusinesses

Zambia’s soybean export data points to a market with real opportunities, but also clear structural constraints. Export markets exist and do pay higher prices on average, but those benefits are not automatically accessible to every producer.

Farmers who are able to aggregate output, meet quality requirements, and coordinate logistics stand to gain the most from export participation. For others, local markets continue to play a vital role in income stability.

At a national level, Zambia’s competitive position is solid rather than dominant. The country is price-competitive, reliable, and well-placed regionally, but faces pressure from lower-cost exporters and fluctuating demand patterns.

Better access to market information, transparent pricing, and organised supply chains will be central to translating export potential into broad-based farmer benefits.

Conclusion

Zambia’s soya bean export performance between 2021 and 2022 shows that exporting is economically attractive under the right conditions. Export prices outperform local prices on a per-kilogram basis, regional demand remains strong, and Zambia holds a competitive middle ground among exporters.

However, exporting is not a universal solution. Without scale, coordination, and cost control, the price advantage disappears quickly. The most viable pathway lies in collective action, improved market access, and data-driven decision-making.

For farmers, the message is clear: understanding where the beans go and who pays more is the first step. Turning that knowledge into profit depends on how production is organised and marketed.

Data Sources

FAO Zambia export data

World Bank Regional export data

Zamstats production data

PMRC Zambia Zambia local price data

https://www.parliament.gov.zm Zambia local price data

https://zambianbusinesstimes.com/fra-maintains-maize-purchase-price/ Zambia local price data